The Ownership Experience

/

Thank you for reading and commenting on the first two Financial Freedom Newsletter. It's been really fun to talk about this. I've taught PUGS Financial Freedom six times in the last year and I've found that so many people have never gotten any education about money and I've found teaching how to take control of your financial life so rewarding. It's been a gift to me.

To recap, I achieved financial independence 3 years ago at age 42 after living on $20,000 and investing everything else for twenty years. In essense, I bought time instead of things or even "experiences." And with the freedom to do what I want, I started PUGS.

Here's a short case study of Olivia and Devin, who took the course this year. Two things I love: they're now able to talk more openly about the financial future. And Olivia has the knowledge and plan to retire in 16 years!

Q: You talk about the "only two (or three) numbers you know to achieve financial freedom"? What are they?

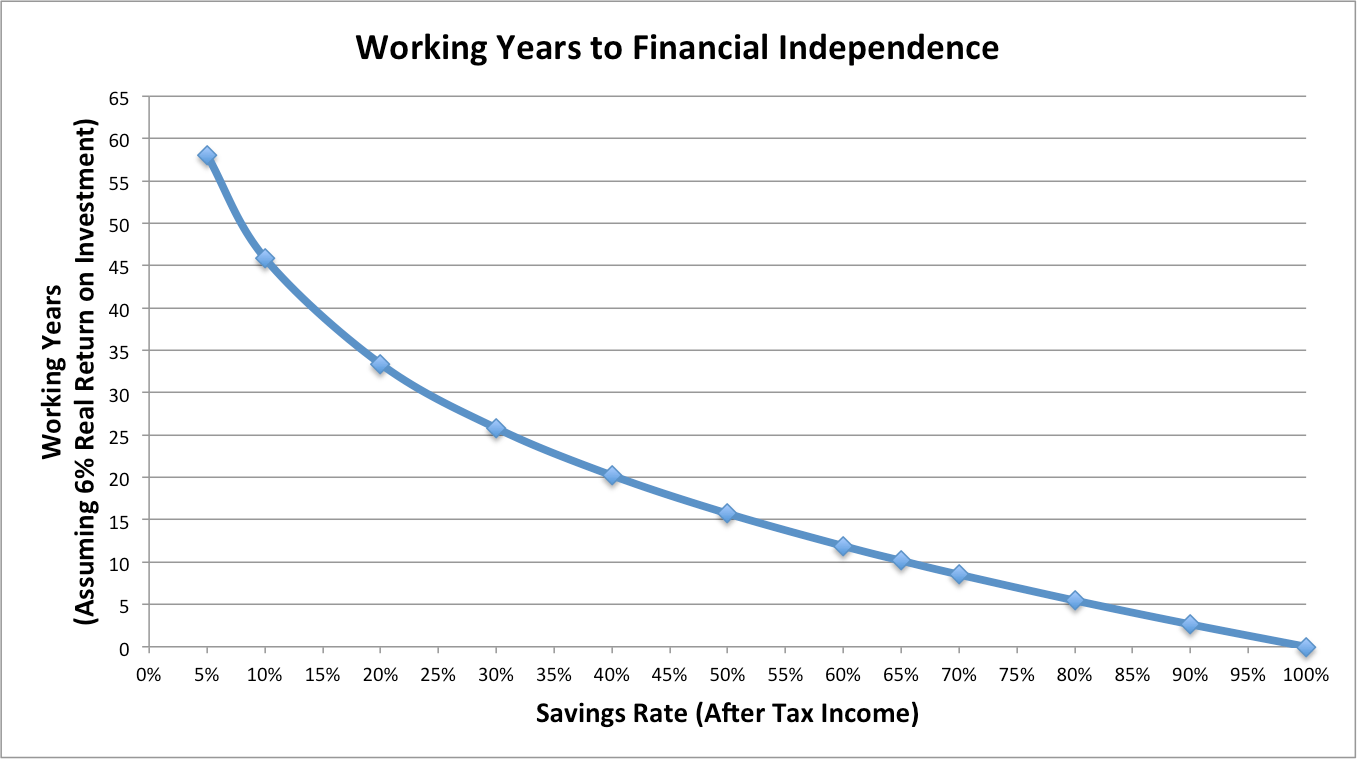

A: Personal finance really relies on two numbers, which creates the third. You need to know your annual salary and your annual expenses. As we talked about in blog post 1, most people know their income but don't keep a budget and have no idea what their annual consumption is and how to control it. When you subtract your annual consumption from your annual income, you get your annual profit. Once you have your annual profit, you can project how long it will take for you to retire. If you have an annual profit of 50%, you achieve financial freedom in 16 years.

I know many of you have this first objection: "But Douglas, there's no way I can save half my income each year!" That may or may not be true, but to paraphrase former Blazer Rasheed Wallace, math don't lie. Since there are only three numbers to play with I have only three suggestions:

- My first go-to is: are you keeping a budget? Do you know what goes to needs, what goes to wants, and what goes to bullshit? That's a core exercise in the course. How you cut into all three of those categories will reduce your consumption.

- You can find ways to increase income. We talk about having an entreprenuerial mindset to your career, possibly starting your own business, or at least running a side hustle. Your current income is in no way the cap on your income potential.

- Lastly, you can target a different number of years to financial freedom.

Is it worth it? Two answers. First, yes. Working towards financial independence means you create some discipline around money in your life and get to spend your life doing what's valuable to you, on your terms. Spend time with family. Travel. Create your art. Make a difference in people's lives. Second, the alternative is SO bad. If you don't plan for financial independence, what happens as you get older? The average American has less than $60,000 in their 401k when they hit retirement age, not nearly enough to live for the following 20 years, even with Social Security. They can either rely on the income of their children or rely on an increasingly fraying social security net. I think it's much better to provide income for your future self now.

I'm almost done with creating the online course! I'm testing out the links and prepping the online community platform. The course will run November and December and it will help people start 2018 with a sense of empowerment over your financial future. And the people I know interested, would make a great cohort. Stay tuned and watch your email for a notice when I open registration.

I would love your comments on this blog or on social media. Thank you again for this opportunity.